Flood insurance through FEMA is the National Flood Insurance Program (NFIP). It has long been one of the more confusing and misunderstood insurance coverages for everyone involved – from insurance agents to mortgage holders – from people buying flood insurance to the federal government. Continuing this trend, FEMA is changing the program they just changed recently. Here is a quick recap of the prior change. In January 2021, five years after releasing preliminary maps, newly revised flood maps were released to the delight of most people. A lot of the barrier island properties on Sullivans Island, Isle of Palms and Folly Beach saw their flood zones and/or base flood elevations become more favorable for their properties, and the cost of their flood insurance dropped significantly. Most of our area was affected by this with more than half seeing a benefit while some ended up worse than before. That whole process probably took at least 8 years of effort and resources. Job done, right?

Wrong – within 10 months of those new maps becoming effective, FEMA has released Risk Rating 2.0 – Equity in Action. I wonder if that catchy tagline took more or less than 5 years to perfect?

So, What’s The Deal With Risk Rating 2.0?

This will be a sincere attempt to simplify what this is but provide relevant information to help provide at least a baseline education of Who, What, When, Why and How – but not necessarily in that order.

Who:

Who will be affected? The overwhelming majority of the Lowcountry will be affected by this change. In addition to this generality, anyone involved in real estate transactions will be seriously affected by these changes, so mortgage brokers and realtors need to be aware of this.

That said, one main part of the program that will remain is that mortgagees will still use the flood zones to determine which properties will be required to purchase flood insurance – those in AE or VE flood zones.

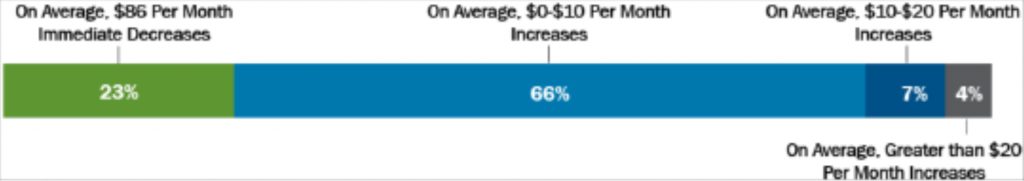

FEMA’s nationwide statistics say that almost 1/4 of policyholders will see their premiums reduced, 2/3 will have their premiums stay the same or increase by less than $1,200 per year (they say $10/month to make it seem low). That leaves just over 10% who will experience increases more than $1,200 per year. For the Lowcountry, we expect these statistics to be more skewed to the increases. Look at it like Breakthrough COVID infections for the vaccinated – the government and media keep telling us they are rare, but it happened to me and a lot of other people I know.

When:

Starting October 1, 2021 – all newly written policies that are effective October 1st or after will be rated using the new risk rating system.

Starting April 1st, 2022 – FEMA will reveal that this has been an extremely elaborate April Fool’s Day prank they used to punk the insurance industry. But really – starting April 1st, 2022, all existing policy renewals will renew using Risk Rating 2.0. This does NOT mean they will experience a ‘drastic’ increase immediately (quotes around drastic since that depends on your definition).

Why:

The NFIP is not performing well. It loses money every year and had accumulated a debt of over $20 Billion as of the end of 2020. Bottom Line – they HAD to change it because the program was unsustainable as it was.

It’s interesting, then, to see how FEMA is messaging this. They keep repeating the statistics on how little impact this will have on the majority of policyholders, but refer back to the prior paragraph. Increased revenue must come from somewhere unless FEMA has figured out how to control Nature and reduce the annual damage that flooding causes.

What:

What changes:

Everything changes, but there are exceptions to everything, yet some of these are only temporary, unless you… Honestly, there is a lot that changes, and most people probably are not interested in the granular details of this. Here are some basic points on what is changing, and I will post a link at the end for those who want the full details:

- Elevation Certificates are not required anymore, but don’t assume they don’t matter. Being able to submit an elevation certificate that paints a picture of a properly elevated and vented house will absolutely help the rate.

- Base Flood Elevation – this is part of the Elevation Certificate and was a KEY data point in flood insurance rating before. It will no longer be used.

- Part of the rating now is the distance to a flood source – AKA the ocean or tidal river. This was not part of the rating before, so this could have a significant impact in the Lowcountry. Think about the barrier island properties who just enjoyed big decreases in their flood premiums. Those islands are pretty darn close to the ocean, so what happens to their newly reduced flood premiums.

- FEMA claims that they will now use the total cost to re-build a house into its rating but will continue to cap the coverage limit to $250,000. For more expensive houses, FEMA will charge more while not providing more coverage. Ironically, this is part of their Equity in Action plan.

What doesn’t change:

- By continuing to cap the amount of coverage available for a house at $250,000 but deciding to charge more for homes that will cost more than that to re-build in reality, FEMA doesn’t change having completely illogical twists in its rating that infuriates and confuses people.

- As mentioned above, mortgage holders will continue to use flood zones to determine which properties will be required to carry flood insurance – these are in flood zones AR and VE.

- Height of lowest living space floor compared to the ground – this is seemingly the only part of the Elevation Certificate that will continue to be used.

- Homeowners selling their house can still transfer their flood policies to the new owners.

What’s the deal with prior claims being forgiven? Is this legit?

Here is our interpretation of this. FEMA forgives but doesn’t forget. It’s similar to when you mess up with your significant other a few times. It comes to a head, you have a long talk through the issues, make up, and come to a truce. Your significant other is willing to let the past be the past and promises to let it go and focus on the future. You both talk about how much your relationship has evolved and how you have both matured and become better people from it. A couple of years of bliss follow, until one beautiful Fall weekend you end up in a horrific fight with your significant other, who proceeds to bring back up all the past grievances you thought were behind you, so you end up back in the doghouse paying for the old stuff all over again.

FEMA does invoke temporary amnesia about past flood claims once a policy is on Risk Rating 2.0. If/When a property files its first flood claim AFTER the transition, FEMA will shake off most of that amnesia at the next renewal. Then, they will add the past claims into the flood rating. In case that was too easy to understand, FEMA has added 2 wrinkles. 1) FEMA will incorporate a rolling 20 year look back for claims history, so old HUGO claims will not be included – ever again. 2) FEMA will still forgive 1 past claim within the 20-year claim history window. This means that if the first claim after Risk Rating 2.0 was the first claim on the property, the claims history rating will have zero claims because it will forgive that claim. For our area, here are the potential flooding events within the past 20 years – so back to 2001:

2017 September – Hurricane Irma

2016 October – Hurricane Mathew

2015 October – Record rainfall

2004 August – Hurricane Gaston

2002 October – Tropical Storm Kyle

How:

FEMA has seen the light! Apparently, they have not been sitting idly by, losing billions of dollars annually running the flood program. Those sandbagging sons of guns have also been learning from their mistakes. When you combine years of learning what NOT to do with private sector data, state of the art Catastrophe Modeling, and cutting-edge Actuarial Science – we get this sleek new Flood Rating System 2.0 plus they threw in an AMAZING tagline for free – Equity in Action!!!

FAQ’s Anticipated

- What are my options if I am buying a house?

- While it is still true that flood policies can be transferred from a seller to a home buyer, our advice is to have the house you might buy quoted with the true Risk Rating 2.0 to see the true rate. Get quotes using the numerous private flood insurance options as well.

- How much will my premium increase?

- It might not increase at all. If you have a property that does experience an increased premium, FEMA caps the annual increase at 18% – each year, which isn’t too generous, if you ask us. 18% increases, compounded, can escalate quickly.

- What happens to Grandfathered flood policies?

- Grandfathering will go away with these policies being put on the same path to their ‘new full-risk rating,’ at the same limited 18% annual increases – compounded.

- How do I get more detailed information on these changes?

- Here is a link to FEMA’s website on this – https://www.fema.gov/flood-insurance/risk-rating

How Can Crescent Insurance Advisers Help?

We believe in educating our clients about these changes, but it is OUR job to know the details of these changes and what that means for our clients. Flood insurance is more than just the NFIP. We write with multiple Private Flood Insurance carriers and look at all the options available to us to find the right option for each of our clients. Feel free to reach out to us with any questions or concerns about flood insurance.