What we are experiencing since January 2023 in the multifamily insurance industry, and coastal property in particular, is unsustainable – especially as owners and managers struggle with the effect that higher interest rates is having on asset valuation.

With the marketplace in this state and lots of accounts getting non-renewed, brokers are being overwhelmed by submissions. It is more important than ever to have an insurance adviser who will take the time to put together a detailed, comprehensive submission. It is important to paint a picture of quality ownership and management to the underwriter, who could be halfway across the country or even across the pond, because that is who will ultimately decide if they want to provide terms and what those terms will be.

This article looks to provide some insight as to how we got here and dive a little into what the effects are.

Part I – Soft Market

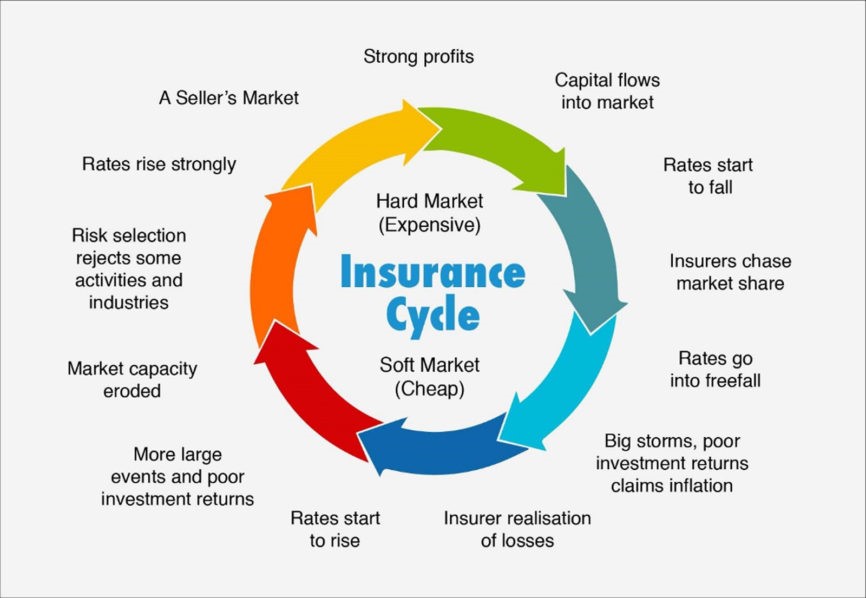

First, let’s review 2 terms that describe the insurance marketplace and trends. For the stock market, rising stock prices represent a Bull market and lowering stock prices signify a Bear market. In insurance, a time where rates are going down reflects a Soft market where increasing rates represent a Hard market.

The insurance industry went through an extended Soft market with only slight blips on the radar where rates barely increased. That lasted until 2019, when rates finally started to noticeably increase. This past soft market was unusual in the excessive amount of capital that flowed into the industry, and specifically reinsurance, to the point that it seems everyone forgot to focus on the fundamentals of solid underwriting and responding to large loss events by adjusting rate. Competition was so intense to write business that deductibles were driven too low, there was no pressure to keep the valuations up to date, and rates remained low despite catastrophic events (the US saw 2 Major Hurricanes make landfall in 2017 (Harvey and Irma) and another in 2018 (Michael)). If a carrier tried to adjust, an insured only had to go to another carrier to keep their valuations and pricing low. Lower deductibles resulted in more frequent claims since lower losses exceeded deductibles. Valuations that remained unchanged for years resulted in properties being drastically underinsured, and this was back in 2019.

Part II – Perfect Storm of Factors

In 2019, the insurance market started to shift after capital started to exit the insurance industry following years of poor performance and multiple factors came together to exacerbate the fallout. This perfect storm of variables included Natural Disasters, Reinsurance problems, and COVID-19 with the resulting supply chain issues and inflation.

Hurricanes and non-wind losses

The US has been hit by nine Category 4 and 5 hurricanes in the last 50 years. Six of those have happened in the last 5 years. Since 2020, there have been nine total hurricanes (not including tropical storms) to make landfall in the continental US. The ninth of these was Hurricane Ian, which hit the West coast of Florida in late September 2022 before re-emerging in the Atlantic and hitting South Carolina, was the latest of these hurricanes and was the straw that broke the insurance industry’s proverbial back.

Simultaneously, non-tropical cyclone events were piling up with winter storms, wildfires, floods, and tornadoes resulting in record losses.

Reinsurance

Reinsurance is insurance for insurance companies. Due to years of under-performance, a number of reinsurance companies have exited the industry, reducing the supply of reinsurance. The companies who remain have been drastically increasing their pricing since about 2019. After Hurricane Ian, the reinsurance renewals in January 2023 forced insurance companies to re-evaluate both their pricing and their overall books of business. This has resulted in enormous cuts in ‘capacity,’ which is the availability of insurance ‘product’ to write. This means that insurance companies are not able to write as much insurance as in previous years.

Inflation

Just when the insurance industry began to play catch up from the overarching problem of property being underinsured, COVID hit. Then the Supply Chain fiasco hit us, and the cost of building materials spiraled out of control. This resulted in already underinsured properties needing extraordinary increases in their property limits to begin to catch up with actual building pricing.

From the perspective of insurance carriers, the losses from those nine hurricanes that have hit the US since the pandemic turned out to be worse than they would have been in part because of these inflation factors. This was a driving force for insurers to require increased limits and to actively manage this better by increasing their minimum price per square foot for replacement cost.

Double Whammy

The increase in hurricane frequency combined with reinsurance costs and inflation issues set the stage for what is happening now with a double whammy hitting multifamily properties. Headlines of rates increasing by 50-75% are misleading because that is only half of the story here. The other half is having to increase the building limits by 25% all the way up to 100% increases. The result is a double whammy of increased rate and forced increase of building limits and has insurance premiums increasing year over year by up to and possibly exceeding 200%.

Part III – The Effects, and What Comes Next

Large carriers reducing capacity

AmRisc has been a massive player in the multifamily insurance space, especially near the coast, for years. Since January, they have lost 3 insurance companies from their ‘panel’ and have had to made big changes. Some of the big changes AmRisc has made on top of increasing rate include:

- Not writing multi-family buildings built before 1995 and non-renewing existing accounts with buildings built pre-1995

- Reducing their limit per location from $300 million to $50 million

- Reducing overall capacity by about 40%

- Increasing their minimum wind deductible

Other carriers are following suit. Catalytic also stopped writing property built before 1995.

Tightening Underwriting and Reduced Coverage

To help reduce losses, carriers have tightened their underwriting to eliminate some properties that have an elevated risk of loss. Frame-built buildings near the coast have been targeted as being too risky, so the companies are looking to minimize that exposure. With fewer companies willing to write these risks and with there not being fewer frame-built buildings around, the cost to insurance these multifamily risks has become incredibly expensive.

Another way the insurance companies have navigated this is by reducing coverage options. It is much harder to find Blanket coverage options, especially for wind coverage on the coast. Increasing minimum wind deductibles to 5% and even higher has become normal. Some carriers are starting to exclude some coverage or implement sub-limits to further manage their exposure.

Conclusion

The difficult reality is that insurance products that were purchased before do not exist anymore. There will be less coverage and higher deductibles for higher pricing. After years of low premiums in the multi-family market with low deductibles and loose terms, a perfect storm of variables has resulted in the most challenging times this space has seen in maybe 30 years. Right now, in 2023, it will be important to turn to an insurance professional who has a focus in writing multifamily accounts and who can help navigate the landscape and find the best value.